Unbiased vetting process

With so many companies and InsureTech startups, carriers face the challenge of vetting, testing and standing up a sandbox environment for a proof-of-concept. Our team of consultants can aid your evaluation process by providing an additional perspective of the assessment and product-fit process.

- Conversational Texting

- Enhanced LeadGeneration

- Fraud Prevention

- TCPA Compliance and Lead Management

- Upgraded Consumer Quoting Experience

- Custom Software Development

Conversational Texting

Conversational Texting platform that combines humanized, automated, AI-Driven SMS and IVR drip marketing campaigns to drive consumer engagement. Platform may be inserted at any or multiple points in the consumer-through-customer journey to increase monetization.

Use case example: turn your leads into high intent inbound calls via Conversational Texting, so you can maximize agent time and reduce your costs. A fully scalable solution, it allows you to increase or decrease your lead flow, via Conversational Messaging, without having to hire or fire agents or worry about space constraints.

Key differentiators

- Conversational texting provides notable lift due to creating a more human interaction v. push notifications

- Managed services provide technical expertise, subject matter experts, campaign designers and customer success consultants that help guarantee maximum results.

- Advanced AI via ~1B+ conversations to-date and handle over 1M leads/conversations daily

- Fully compliant platform that can process up to 150,000 different ways to opt-out a consumer.

Attract more in-market consumers with LeadGen providers aligned with your business

Our consultants at Felton Solutions have extensive experience establishing & managing lead generation programs within the Insurance industry. This level of insight, allows us to provide a unique perspective of the Lead Generation’ provider landscape, while making recommendations only where it makes sense to do so.

If you’re interested in engaging with one of our represented organizations, connect with us at connect@feltonsolutions.com

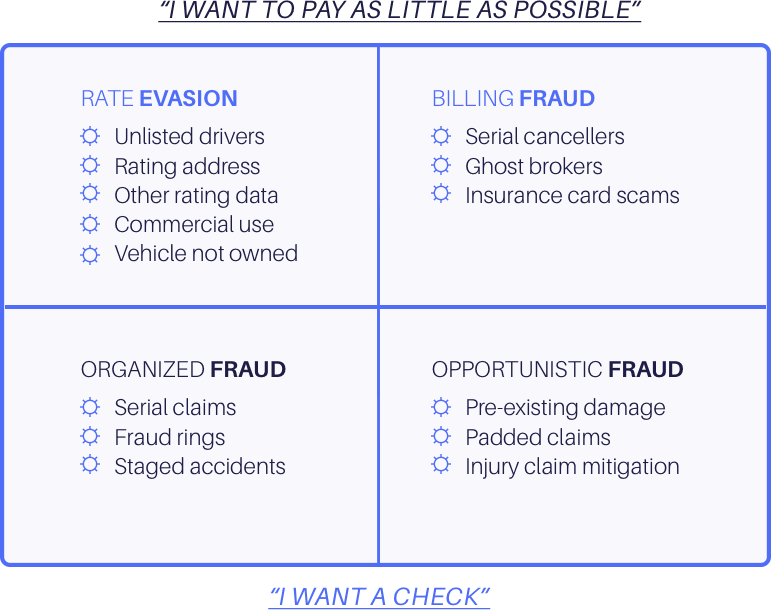

Stopping fraud before it happens

Leverage a platform that provides point-in-sale/in-transaction rate evasion and fraud detection solutions to US Auto (and soon home) insurance carriers via a suite of insurance-purposed cloud services.

Rapidly improve carrier bottom lines by 10%, 20% or even 30% of net premiums, written and does so with limited customer IT/integration costs or interference with the sales process.

Fraud and rate evasion problems can be solved

A unique platform designed to identify, intervene and eliminate a wide range of common and expensive fraud problems.

Consent-Based Marketing

With a consent-based marketing approach, our partner helps companies acquire and manage leads and customers. The platform helps improve cost-per-policy ROI with lead enhancement and workflow rules that ensure you accept only the leads that are most likely to convert, lowering your cost-per-policy while raising conversion rates.

Key differentiators

- Protects companies across different industries from litigation by documenting proof of consent (protect and certify lead data)

- Lead optimization and enrichment via available data in the partner’s marketplace; tracks and reports every step of the lead flow

- Integrations to existing Web forms and lead generations platforms facilitate the lead acquisition process, serving as a single system for lead entry and management

Simplified and Upgraded Online Consumer Experience

An Insurance technology platform, our partner provides secure, digital solutions that help consumers get the most value from their car and home insurance. Our partner’s platform makes it easy for consumers to securely access and compare their existing coverage in order to make smarter and more confident decisions online.

Key differentiators

- Reduce friction for consumers and lower acquisition costs

- Securely and accurately prefill an entire application with current declarations

- Be bold – take charge of your consumer experience to increase market share with consumer-initiated side-by-side comparisons

- Grow intelligently; know more about new customers – write the right type of business

Digital transformation and custom software development

Our partner is a software services firm focused on helping insurers meet their strategic and operational goals by providing remote, dedicated software development teams from multiple nearshore delivery centers. The company has worked directly with insurance providers for well over a decade, as well as working with major corporations like Best Buy.

Key differentiators

- Cost-effective. Remote / same hemisphere provides streamlined communications with teams aligned to US time zones

- Provide thought leadership and project management

- Engagement models include project managed pods, staff augmentation and certified Salesforce Developers

Unbiased vetting process

With so many companies and InsureTech startups, carriers face the challenge of vetting, testing and standing up a sandbox environment for a proof-of-concept. Our team of consultants can aid your evaluation process by providing an additional perspective of the assessment and product-fit process.

Conversational Texting®

Conversational Texting platform that combines humanized, automated, AI-Driven SMS and IVR drip marketing campaigns to drive consumer engagement. Platform may be inserted at any or multiple points in the consumer-through-customer journey to increase monetization.

Use case example: turn your leads into high intent inbound calls via Conversational Texting, so you can maximize agent time and reduce your costs. A fully scalable solution, it allows you to increase or decrease your lead flow, via Conversational Messaging, without having to hire or fire agents or worry about space constraints.

Key differentiators

- Conversational texting provides notable lift due to creating a more human interaction v. push notifications

- Advanced AI via ~1B+ conversations to-date and handle over 1M leads/conversations daily

- Fully compliant platform that can process up to 150,000 different ways to opt-out a consumer

Attract more in-market consumers with LeadGen providers aligned with your business

Our consultants at Felton Solutions have extensive experience establishing & managing lead generation programs within the Insurance industry. This level of insight, allows us to provide a unique perspective of the Lead Generation’ provider landscape, while making recommendations only where it makes sense to do so.

If you’re interested in engaging with one of our represented organizations, connect with us at connect@feltonsolutions.com

Point-of-sale rate evasion and fraud detection

Leverage a platform that provides point-in-sale/in-transaction rate evasion and fraud detection solutions to US Auto (and soon home) insurance carriers via a suite of insurance-purposed cloud services.

Rapidly improve carrier bottom lines by 10%, 20% or even 30% of net premiums, written and does so with limited customer IT/integration costs or interference with the sales process.

Product showcase

- Enable carriers to authenticate customer mobile devices and request images of vehicles, documents and other assets before allowing customers to purchase a policy or process a change. Images are ‘scrubbed’ via AI services to confirm the images are complete and accurate – and are returned to the carrier with a wide array of device metadata.

Win back lost revenue

A chargeback mitigation solution that builds the best evidence in the industry to help you beat the odds. Combining the power of AI with human expertise, it is easily deployed, user-friendly, efficient, and accurate.

Key differentiators

- Highest win rates – custom built solution to maximize results

- Hands-off solution – focus on growing your business instead of chasing chargebacks

- Solution for payment service providers – empower your merchants/agents, and eliminate support teams’ involvement in managing merchant chargeback requests

Digital transformation and custom software development

Our partner is a software services firm focused on helping insurers meet their strategic and operational goals by providing remote, dedicated software development teams from multiple nearshore delivery centers. The company has worked directly with insurance providers for well over a decade, as well as working with major corporations like Best Buy.

Key differentiators

- Cost-effective. Remote / same hemisphere provides streamlined communications with teams aligned to US time zones

- Provide though leadership and project management

- Engagement models include project managed pods, staff augmentation and certified Salesforce Developers